Various organizations collect and aggregate transaction and market data on crypto-assets from crypto-exchanges and released in multiple forms. I have been browsing the coinmarket.com for quotes and transaction amounts calculated by using data provided from crypto-exchanges worldwide through API connection.

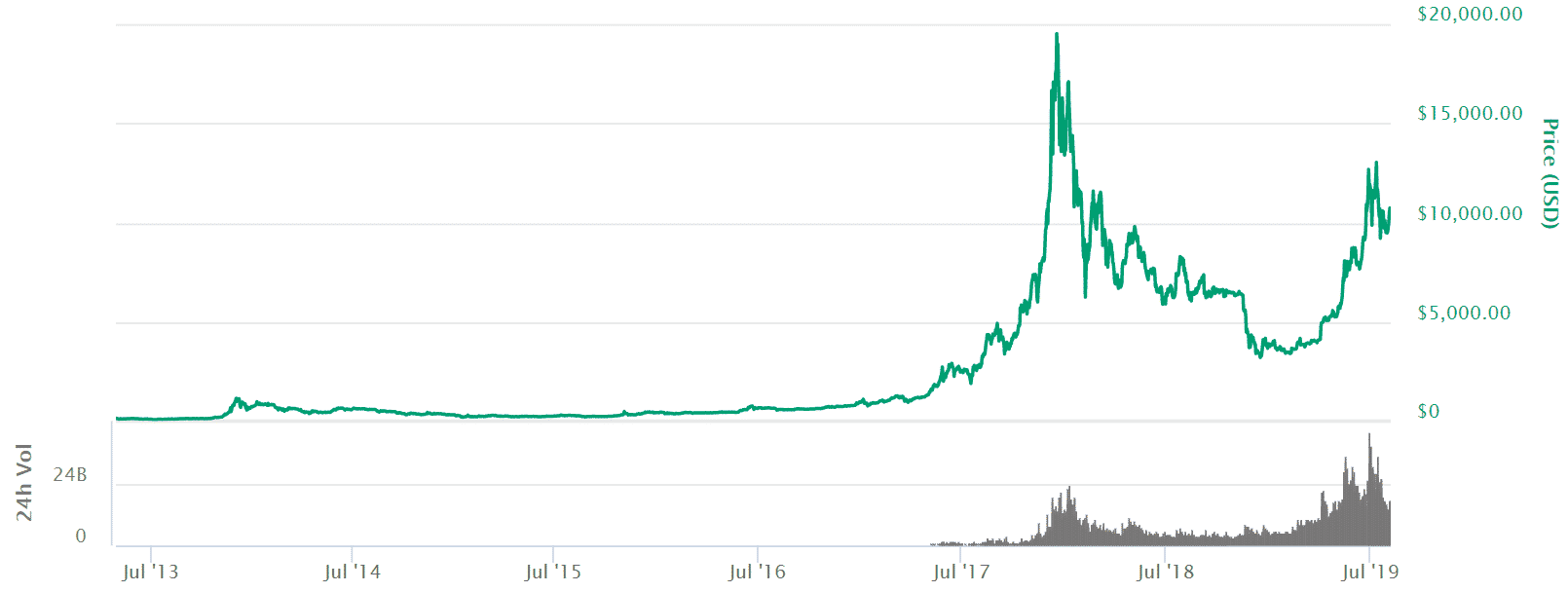

The chart shows BTC quotes and transaction values (Bar chart at bottom) from coinmarket.com, with two peaks in transaction value. At the end of 2017, the BTC price soared, and in 2019, the BTC price rose again. The BTC price reached $20,000 in 2017, only slightly above $10,000 in 2019. But the volume of transactions was much larger in 2019 than in 2017.

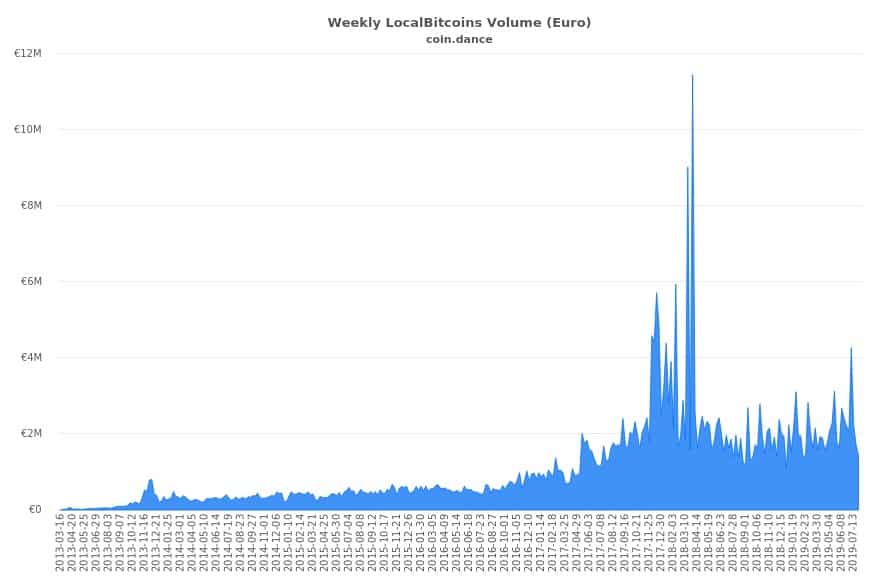

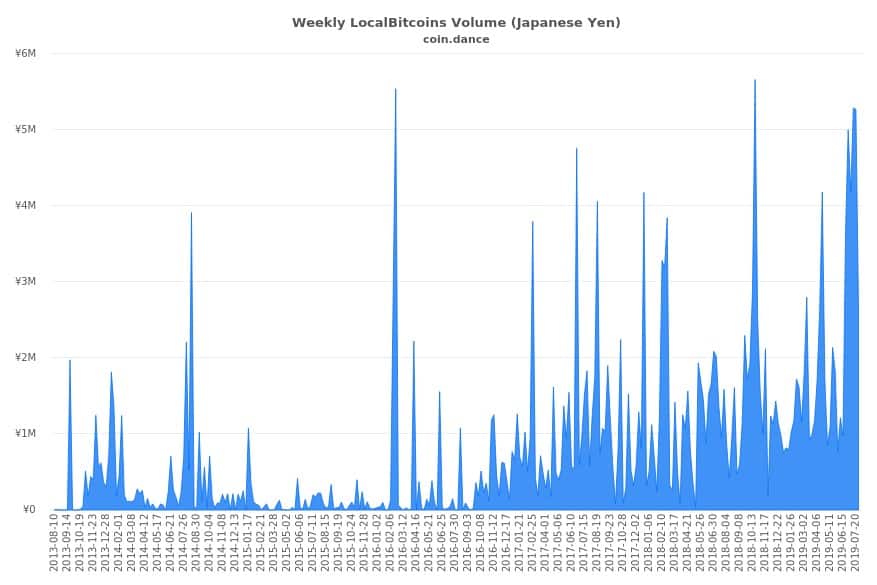

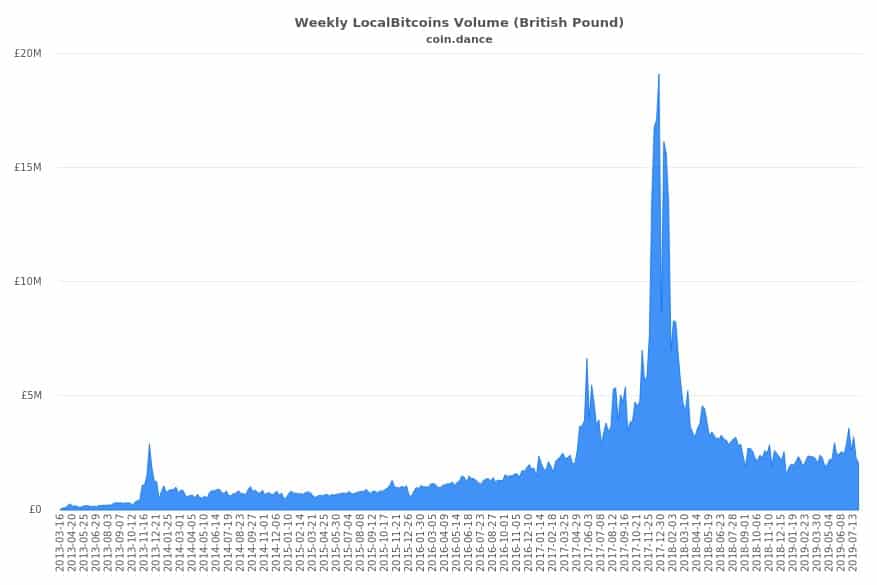

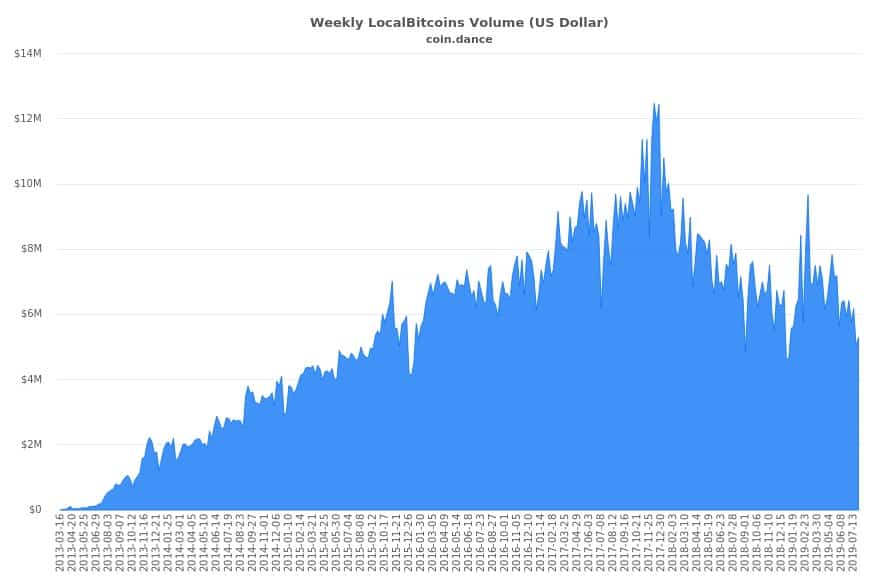

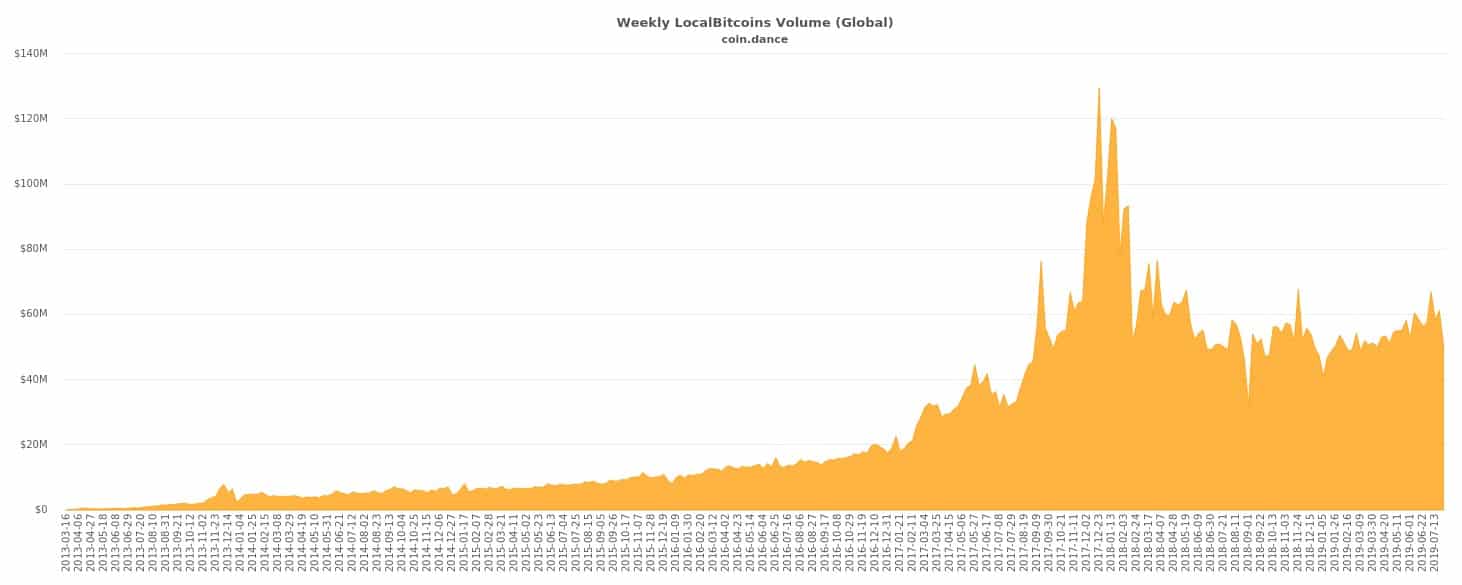

In contrast, the transaction values provided by coin.dance are quite different. These statistics are the sum of the amounts of local transactions exchanged with the fiat currency at each exchange, excluding transactions between crypto-assets (For example, BTC – Tether). Unlike coinmarket.com, this chart shows steady growth, with recent local transactions flat after the 2017 boom.

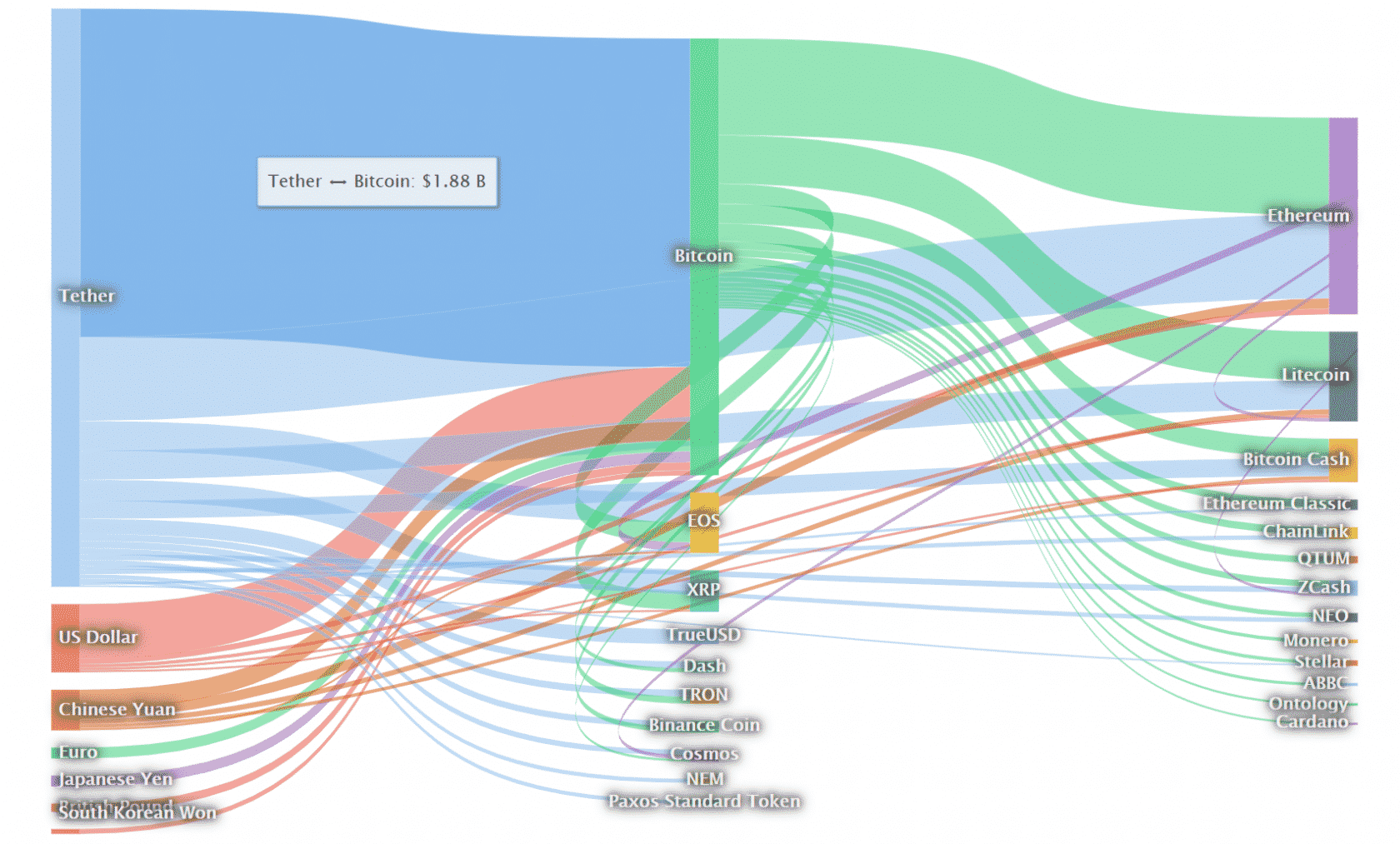

The transaction value of coin.dance in 2019 did not exceed its peak in 2017. This fact raises a question about the accuracy of coinmarket.com. Indeed, it is often pointed out that special trading entities called “whale” are raising the price by repeatedly playing catch in the crypto-asset market. A money flow diagram of coinlib.io shows that transactions among BTC, Tether, and ETH are the mainstream of transactions, and exchanges with fiat currencies and crypto-assets are a small part of transactions.

As I’ve written several times, this playing catch among crypto-assets could be market manipulation using Tether issuance. So the more accurate representation of normal trading participants’ behavior could be the data on coin.dance.

This coin.dance data is also useful in determining which countries are active in local transactions for each fiat currency traded. Of course, all of these data are self-reported by the crypto-exchanges. So it needs to be carefully examined for its authenticity, but I would like to focus on the fact that a trend that has changed recently, especially in Latin America.

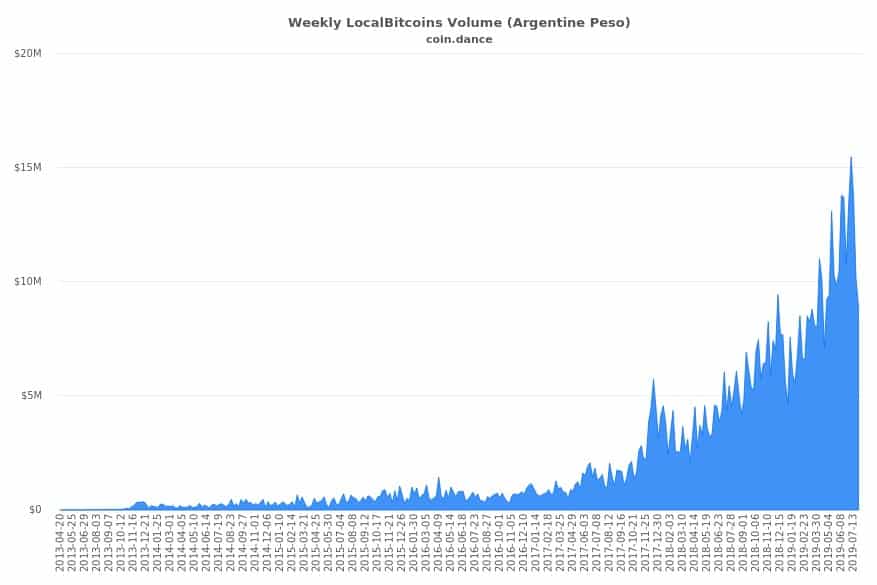

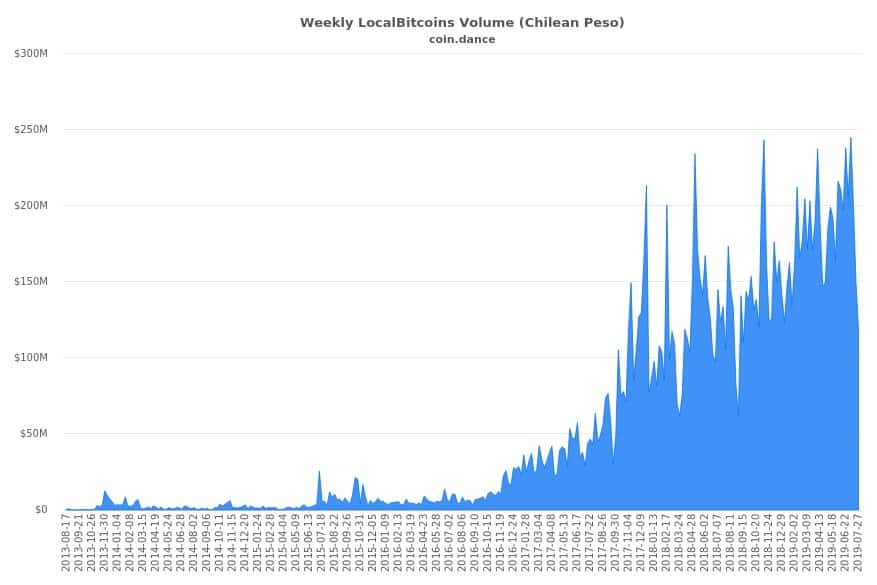

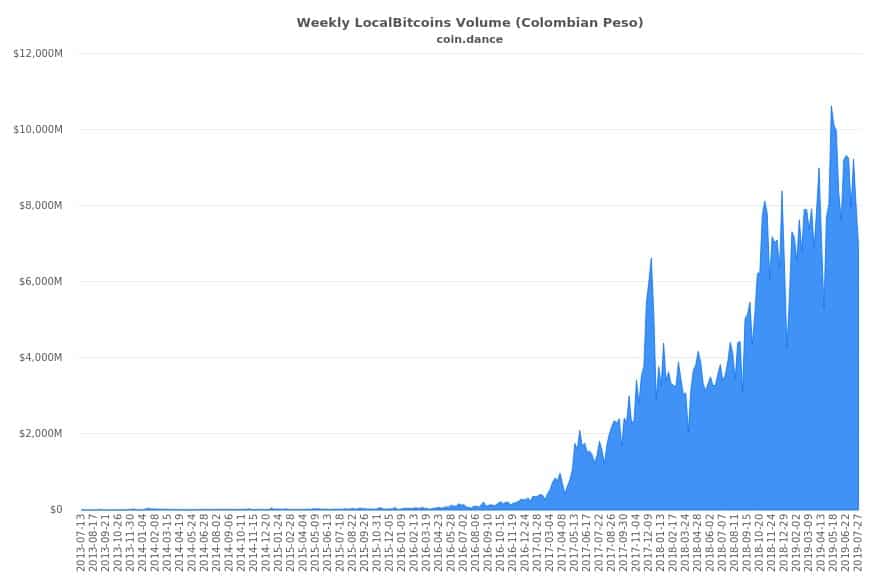

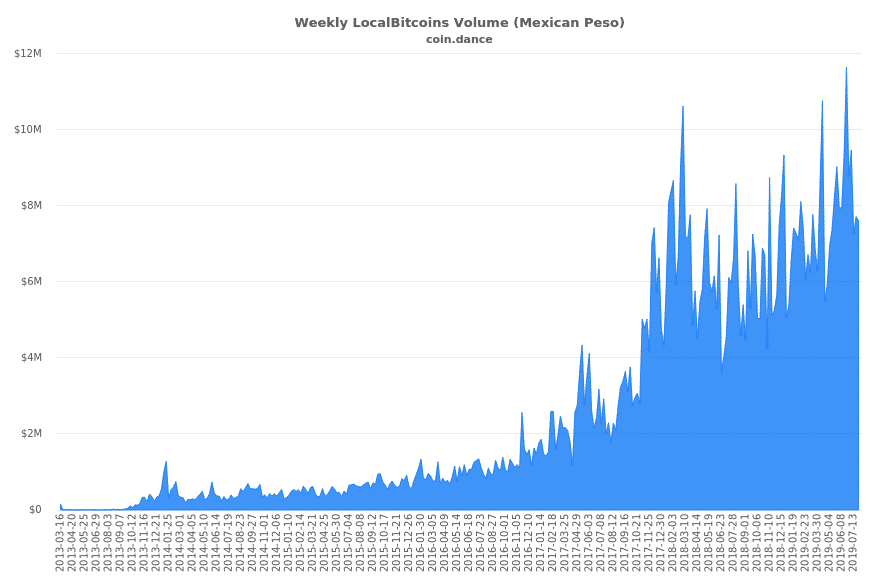

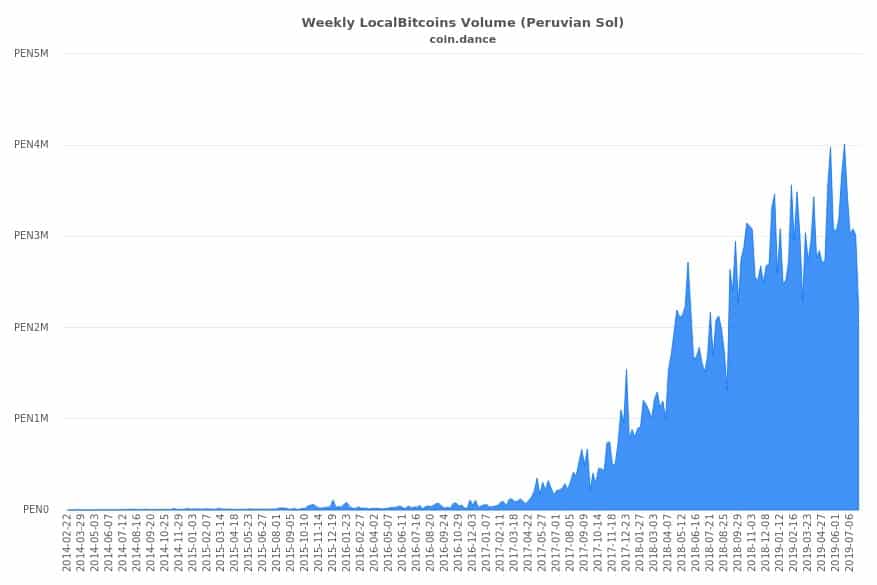

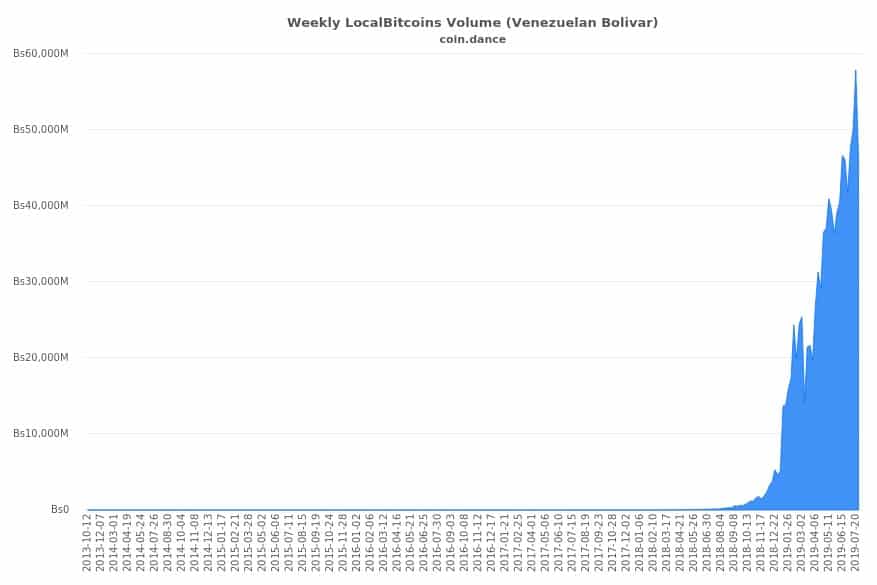

The following charts show the amounts of local bitcoin transactions in Latin America (All time series are almost the same as the aggregate data). Since 2017, the number of transactions has been increasing, with a peak in 2019. From the upper left are Argentina, Chile, Colombia, Mexico, Peru, and Venezuela. However, since these charts use local currencies on the vertical axis, the transaction value tends to deviate upward when the currency value declines. In Venezuela, the currency value has declined sharply due to hyperinflation, so this chart alone does not show how the value of transactions measured in US dollars has changed.

In Venezuela, hyperinflation had rendered the national currency worthless, and crypto-assets replaced legal tender in 2018. More recent news suggests that the value of transactions on BTC basis has declined sharply as even crypto-assets have become unavailable due to instability in power supply and communications infrastructure.

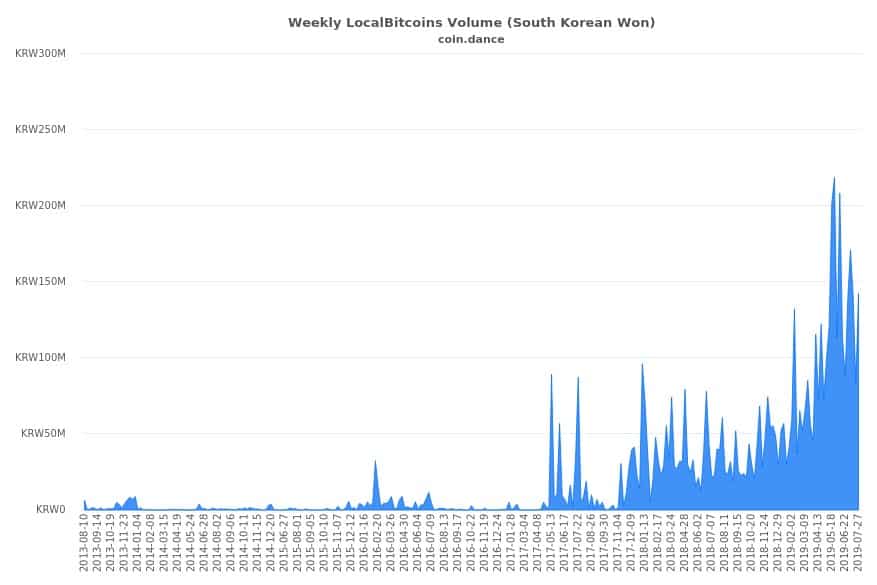

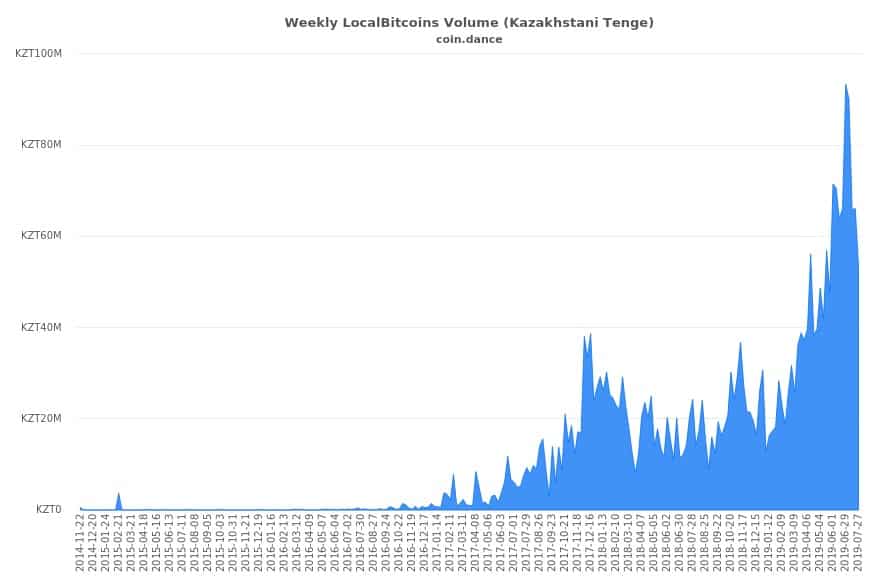

Although Venezuela is a special case, the popularity of bitcoin in other Latin American countries does not seem to indicate that bitcoin is being used as a payment method instead of the fiat currency in those countries. Rather, it appears that investors worried about falling fiat currency values have chosen bitcoin as a haven for their assets. Korea and Kazakhstan (two charts below) also have similar trends.

On the other hand, in the developed countries, Japan, Europe, and North America have not been affected much by the recent rise in the prices of crypto-assets, and the trend of transactions has not changed much. If you have a high level of trust in your currency, you don’t have to have highly volatile bitcoin. There has been less speculative activity than in 2017 (the charts below, from top left, shows the euro area, Japan, UK, and US.).

The question is whether investors in Latin America, which have been fleeing assets into bitcoin amid fears of a weak currency, will be able to hit or miss their purposes. When we look at the BTC market in the future, we need to be aware that there are many different positions.