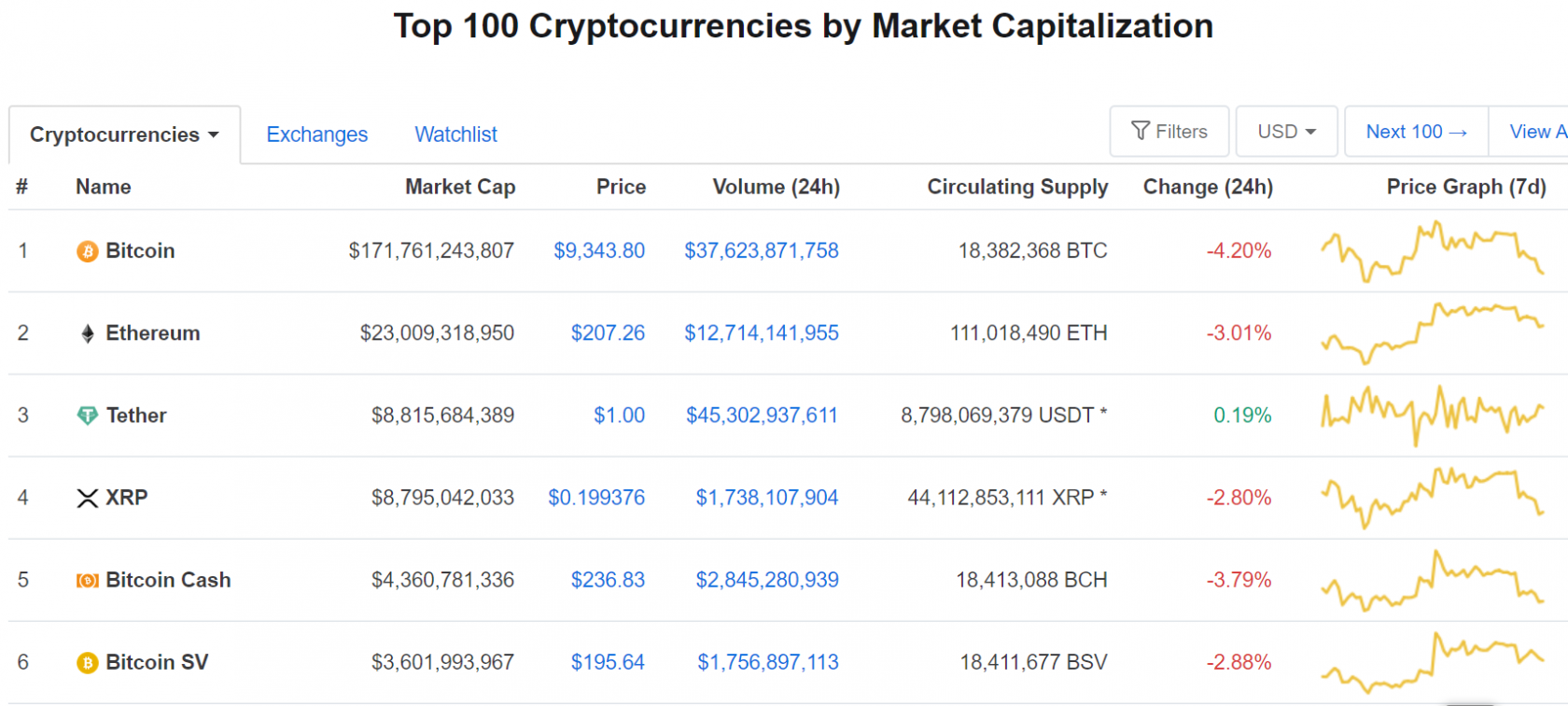

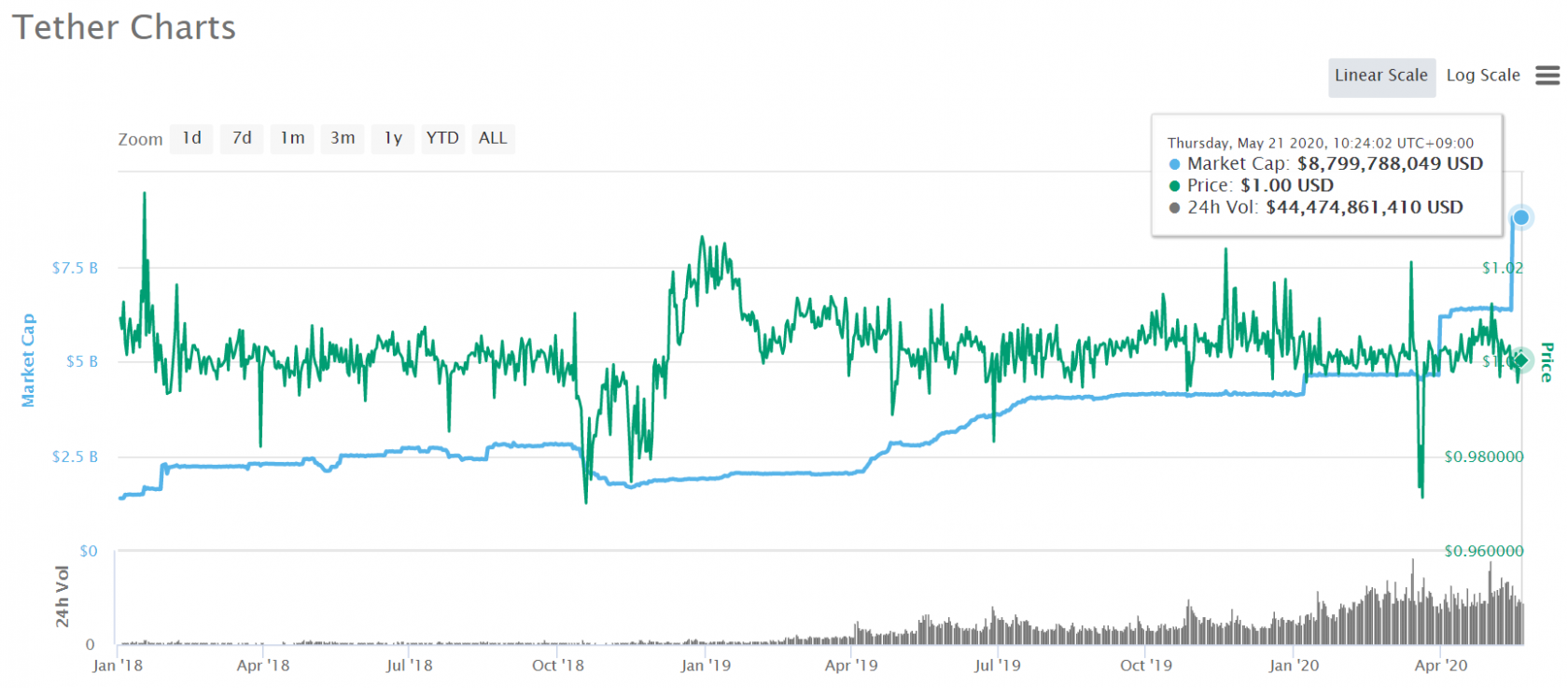

Finally, Tether has moved up to #3 on coinmarketcap.com‘s crypto-asset ranking. It recently increased issuance $1.5 billion from $7.3 billion to $8.8 billion, and as other crypto-assets fell a bit in value, it overtook XRP to take third place. The ranking of “Bitcoin, Ethereum, and Tether” seems a bit outlandish.

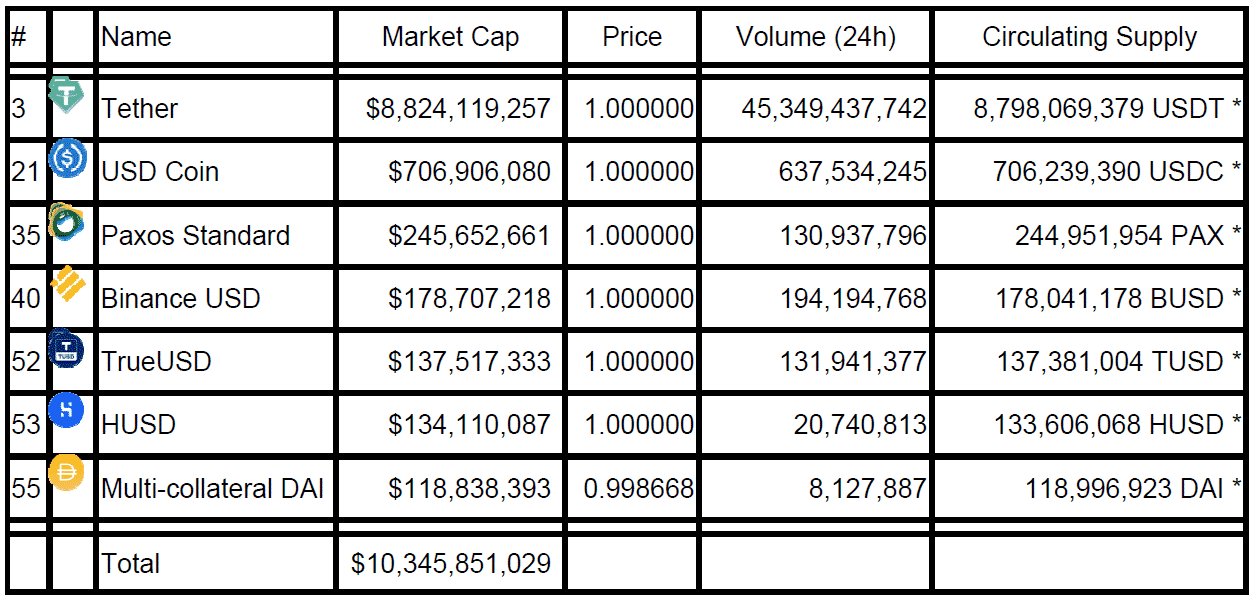

Now, not only Tether but also many stablecoins are issuing freely. In order of the amount of US Dollar-linked stablecoins alone, Tether, USD Coin, Paxos Standard, Binance USD, TrueUSD, HUSD, and Multi-collateral DAI, there are seven coins in the top 100, with a total value of over 10 billion dollars.

Holding stablecoins without regulation or adequate disclosure, and trusting the issuer’s claims are nothing less than taking the issuer’s credit risk. I’m not sure why Bitcoin investors hold stablecoins without thinking about the credit risk of issuers. I suppose it is customary of investors to trust only the counterpart exchange in transactions of crypto-assets, so they are not afraid of the default of the exchange, which is also the issuer of stablecoin.

The original philosophy of Bitcoin was to allow people to exchange value online, even if they didn’t trust anyone. That’s why Bitcoin-specific values, such as “decentralized” and “trustless” were created. I think it’s also a mystery that investors who believe in this idea trust only the counterpart exchange, those who have never met. Not everyone who invests in Bitcoin believes in the concept, but then, why would they think Bitcoin is worthy?

If such a curious structure seeps into the general public and dulls its perception of credit risk, it is likely to be troubling. Recently, there has been a trend to stimulate investment in the real world, even if it makes people insensitive to risk. Maybe what’s happening in the crypto-asset world is a mirror of the real economy.