A week or so ago, Bitcoin plunged from $8000 to $4000, sending the crypto-asset market into turmoil, but that turmoil is spilling over into stablecoin, which advocates one coin to one dollar. Specifically, the March 13 crash saw funds exited from priced crypto-assets such as Bitcoin turn to stablecoin, boosting its price. This phenomenon is often seen when the crypto-asset market has fallen. Usually, it immediately returns to 1 coin = 1 dollar. Still, this time, the market has followed a slightly different trend since then.

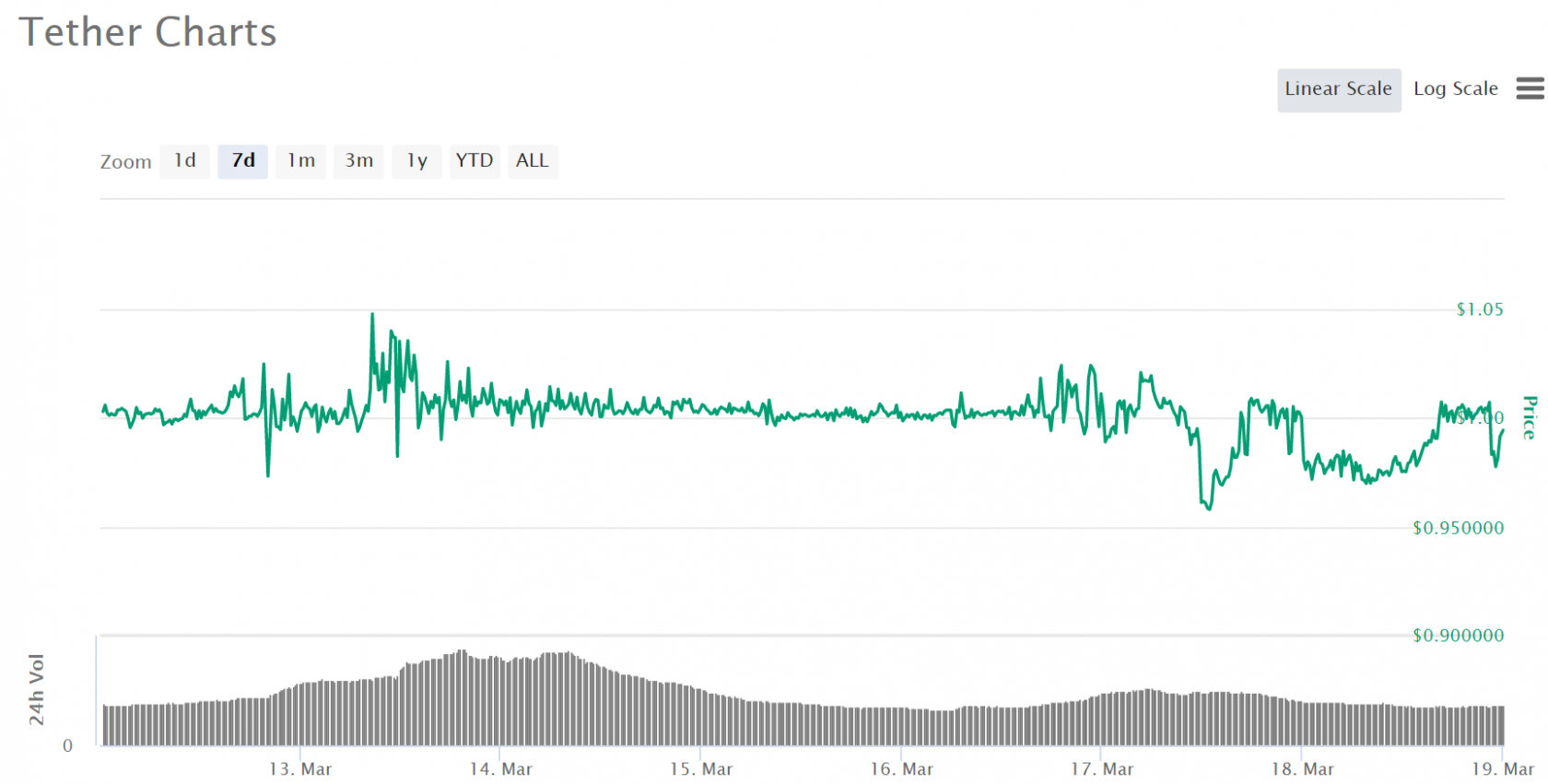

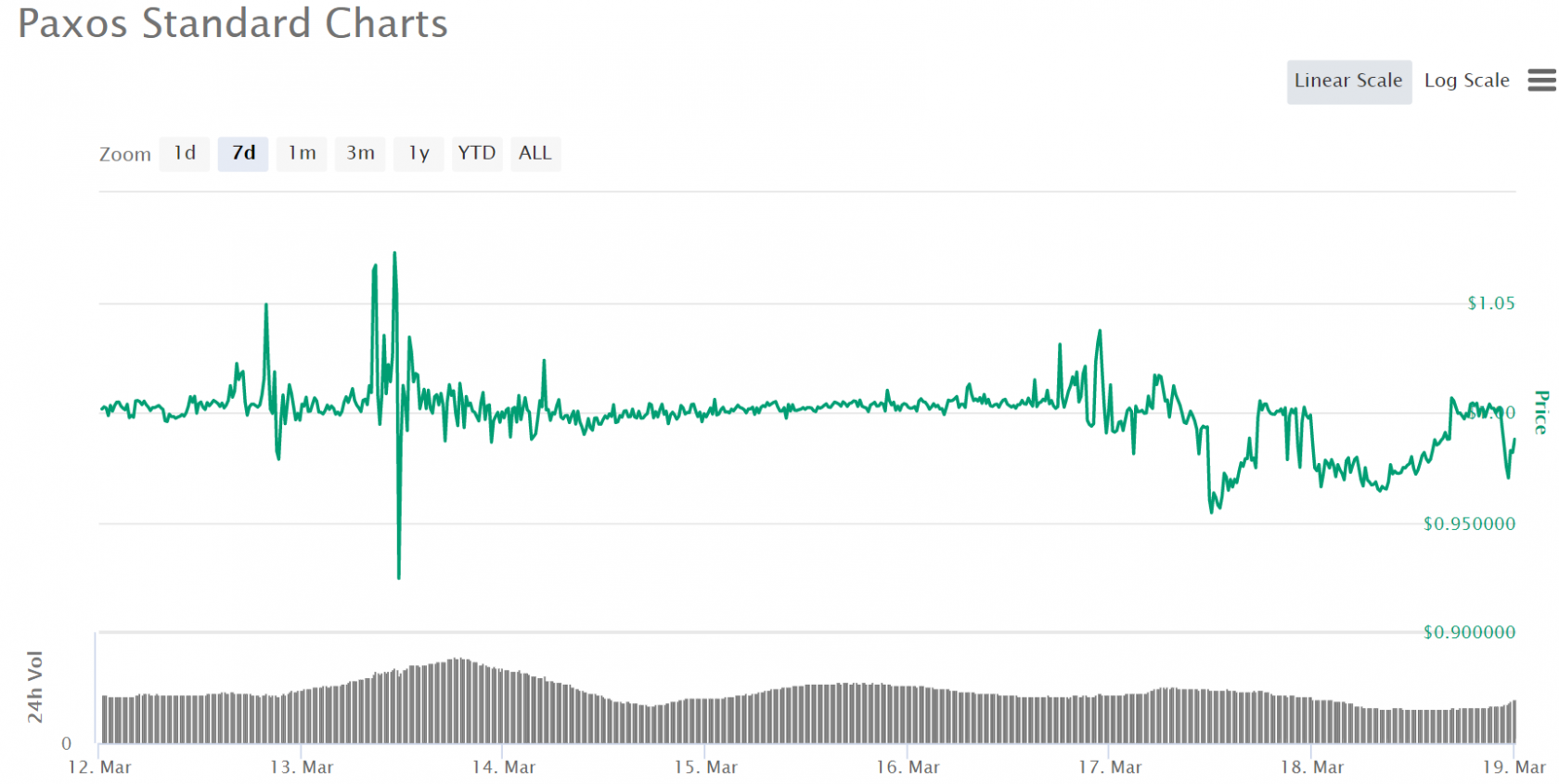

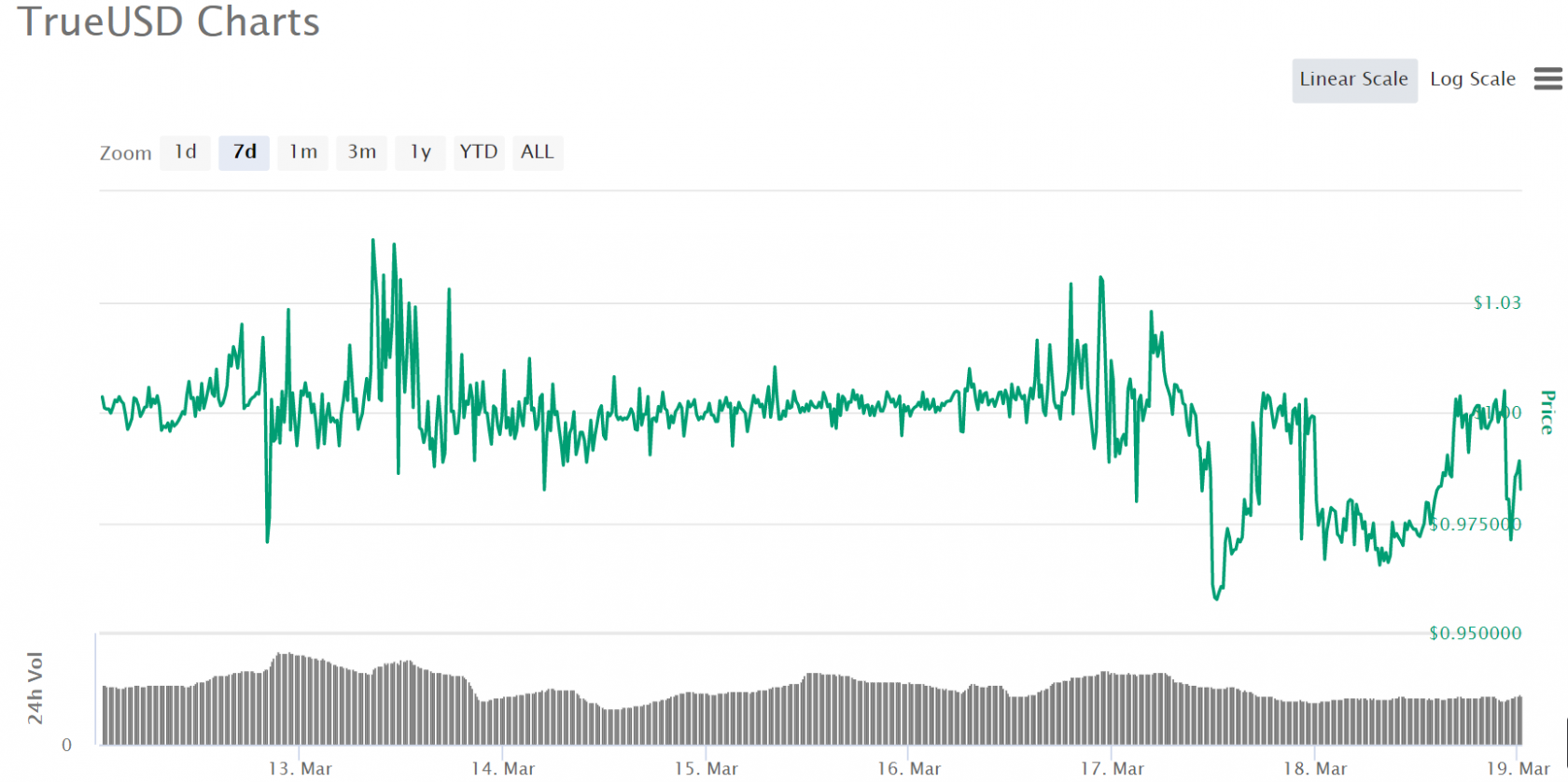

The prices of Bitcoin and other popular crypto-assets have remained mostly unchanged, having fallen a week ago. Stablecoins are in a modulation that has not been seen in the past when crypto-assets have stabilized. In particular, on March 17-18, five “1 coin = 1 dollar” stablecoins (Tether, USD Coin, Paxos Standard, Binance USD, and TrueUSD) fell off target. Below are the weekly price changes for each Stable Coin. The scale of the vertical axis is different depending on the coin. If we correct for the scale, you can see that the movement is almost the same.

The deviation from the target seen this time was a drop of about 4-5%, which is not often seen when crypto-asset markets are moderate, as the coin is now $0.95. During this time, I don’t think there was any sudden increase in the issuance of stablecoins, nor was there any bad news in confidence in stablecoins.

What is interesting is that the five different types of stable coins, each of which has a different structure and construction, have shown similar price movements as if they were being arbitraged against each other. While the crypto-asset market has been relatively stable, it is natural to assume that this move has been influenced by international stock price fluctuations caused by the corona shock.

For now, the traditional financial markets, such as short-term financial markets and general bank deposits, are considered to be separated from the market for crypto assets. But, of course, there will be those who are involved in both on the investor side. It is often rumored that a certain percentage of private equity and other funds are managed with crypto-assets.

If such investors are reducing their investments in crypto-assets and various risky assets such as equities and crude oil and cashing them in, then it’s no wonder all markets are affected.

The crypto-asset market crash a week ago was reportedly caused by the corona shock. When that happens, investors who have let go of Bitcoin will get stablecoins in return. However, since there is not as much trust in stablecoin as there is in bank deposits, they move it to the traditional side of finance (general deposits) after a certain period. I have a hypothesis that that may be the identity of the modulation that stood in the stablecoin market on March 17-18.

Unfortunately, we don’t know much about what kind of money flows occur between crypto-asset markets and bank deposits, as there are no reliable statistics. The coinlib.io/global-crypto-charts, which was useful for grasping the big picture, has been out of view for a week now.

As I’ve written about in the past, various allegations have been reported that Tether has not fully disclosed. It is often explained that other stablecoins also hold legal tender that is commensurate with the amount of money issued. Still, since they are operated as a sideline for major crypto-asset exchanges, it is unlikely that they will be able to maintain their credibility if the exchange’s management slips in the face of a falling bitcoin market. This is because they are not protecting investors with legally effective mechanisms such as bankruptcy remote.

In that sense, the modulation that stood up this time may be a harbinger of more significant fluctuations that will occur in the future.