Total market capitalization of crypto-assets had been falling since the beginning of the year. From August to the first half of November, it remained around $ 200 B steady. However, after repeated crashes on November 15th, 20th, 25th, it fell to $ 120 B.

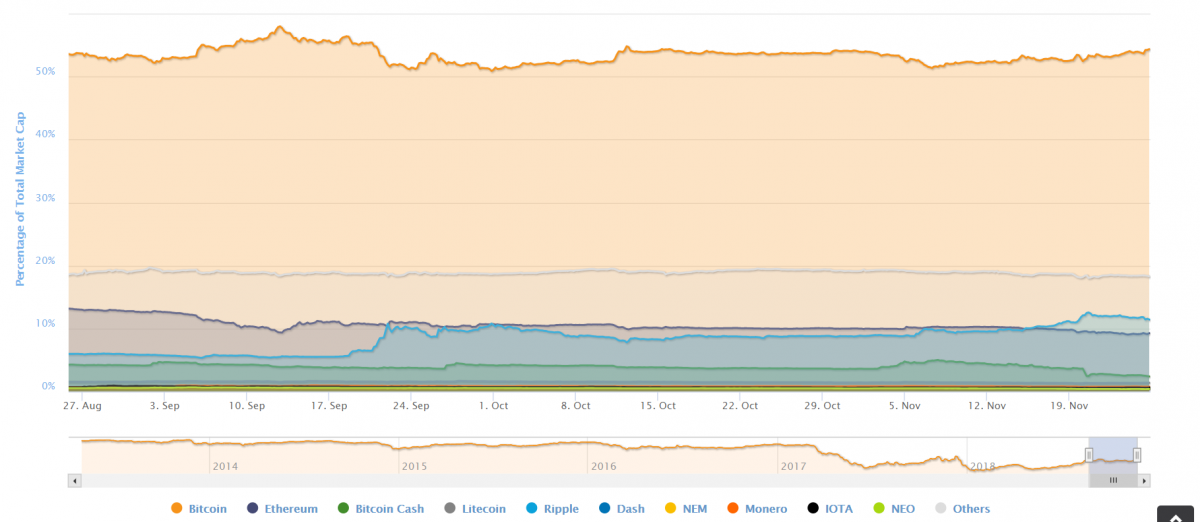

By coins, the share of BTC does not change significantly in the 50% range. The price of BTC also fell from $ 6500 / BTC to $ 3800 / BTC. Among alt-coins there was a relative decrease in BCH, ETH, and a corresponding rise in XRP. However, all of them fell sharply in November at the absolute level.

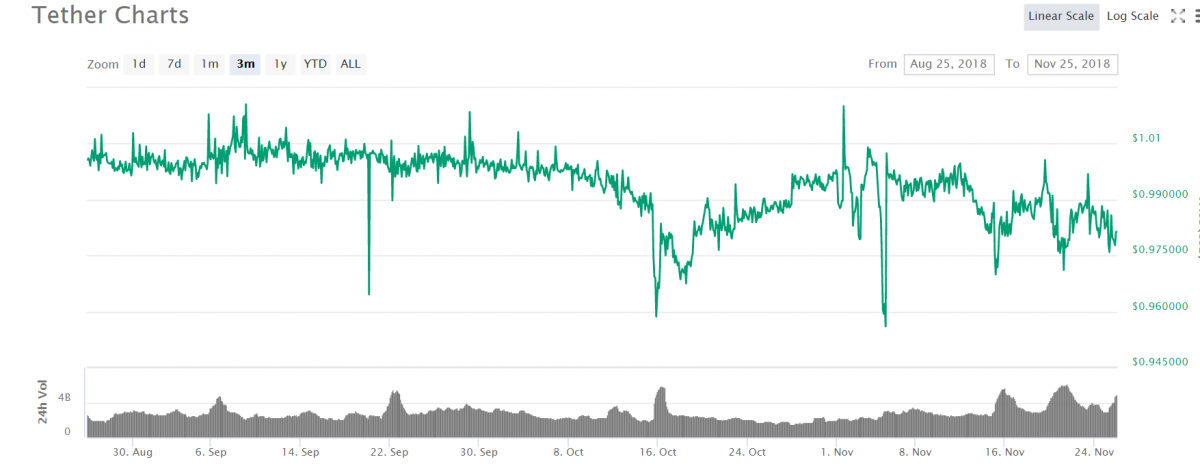

Regarding the cause of the crashes, the media claims the influence of “hash war” over BCH. However, I think that it is just a trigger to boost contradictions accumulated in the past. In particular, it is also a great weight that the “stable coin” Tether (USDT), which has a large transaction amount next to BTC, has become impossible to maintain the peg of 1 USDT = $ 1.00. Since mid-October, the USDT has repeatedly diverged from the target. The crypto-asset market money has frequently moved in search of an escape place, resulting in a simultaneous parallel decline in the entire market.

It may have been somewhat unnatural that the crypto-assets that generate no cash flow at all and had no theoretical background with any price level had kept stable market prices for a considerable period. Although there will be turbulence in the market prices, I think that it is difficult to imagine a scenario that they will soar again. Many economists claim that “the intrinsic value of crypto-assets is zero.” I believe that it is time to listen to such opinions calmly.

Blog

- Categories

-

- A Day in My Life (5)

- Abolition of Hanko (2)

- Beautiful Scenery (5)

- Blockchain (4)

- Business Trip (3)

- Campus Life (3)

- Cashless Society (3)

- COVID-19 (1)

- Crypto-Assets (Virtual Currency) (23)

- digital currency (1)

- Economic Policy (1)

- essay (3)

- Events in Kyoto (3)

- Financial innovation (2)

- Financial IT (5)

- Fintech (10)

- Global environmental issues (1)

- Information Security (3)

- lessons of the remote classroom (1)

- Libra (2)

- Media Literacy (1)

- movies (2)

- My Views on News (5)

- Notification (5)

- Paper (7)

- Press (4)

- Regulatory Reform Promotion Council (1)

- Speech (11)

- YouTube (4)